- Introduction to FintechZoom Credit Cards

- What Are Credit Cards?

- Why Are Credit Cards Important?

- Overview of FintechZoom

- FintechZoom: The Go-To Platform for Financial Advice

- How to Choosing the Best Credit Card

- Key Factors to Consider

- Understanding Your Spending Habits

- Top Credit Cards for Cashback in 2024

- Best Overall Cashback Cards

- Best Cashback Cards for Groceries

- Best Travel Rewards Credit Cards

- Top Travel Cards for International Travelers

- Best Domestic Travel Credit Cards

- Low Interest Credit Cards

- Best Cards for Low APR

- 0% Introductory APR Cards

- Best Credit Cards for Students

- Why Students Should Use Credit Cards

- Top Student Credit Cards for 2024

- Credit Cards with the Best Sign-Up Bonuses

- Cards Offering the Most Generous Welcome Offers

- Best Cards for Building Credit

- Secured vs. Unsecured Credit Cards

- Best Cards for Improving Your Credit Score

- Credit Cards with No Annual Fee

- Why No Annual Fee Cards Are Popular

- Top No Annual Fee Cards for 2024

- Premium Credit Cards

- Best High-End Credit Cards with Exclusive Perks

- Is a Premium Credit Card Worth It?

- Credit Cards for Small Business Owners

- Best Business Credit Cards for Entrepreneurs

- Benefits of Using Business Credit Cards

- How to Maximize Credit Card Rewards

- Tips for Earning the Most Points

- How to Use Rewards Responsibly

- Common Mistakes to Avoid with Credit Cards

- Over-Borrowing and Debt

- Missing Payments and Interest Rates

- Conclusion

- Choosing the Right Credit Card according Your Needs And Requirenments

- FAQs

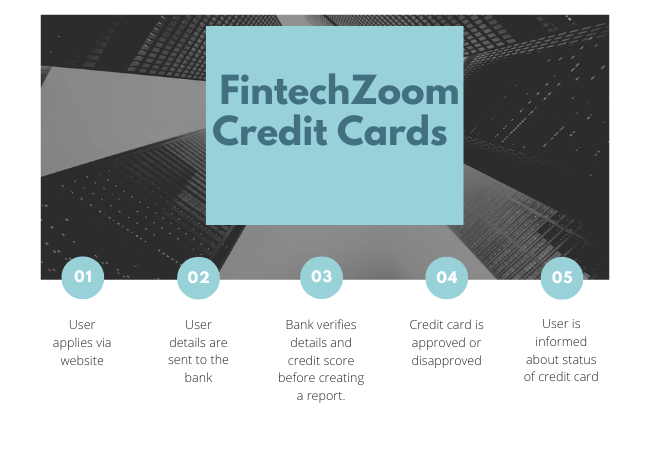

FintechZoom Credit Cards

Credit cards have become an essential tool in managing personal finances, providing convenience, rewards, and financial flexibility. However, with so many options available, selecting the best credit card can be overwhelming. In this article, we’ll break down the top credit cards of 2024 based on various categories like cashback, travel rewards, low interest rates, and more.

Introduction to FintechZoom Credit Cards

What Are Credit Cards?

A FintechZoom Credit Cards is a financial tool that give permission to users to borrow funds from a bank or financial institution to make purchases. You agree to pay back the borrowed amount plus any interest, depending on the card terms. They are widely used for day-to-day transactions, online shopping, and even travel bookings.

Why Are Credit Cards Important?

Credit cards are essential for managing your all type of your balance. They help in building credit history, offer convenience, and come with several rewards like cashback and travel miles. They also offer protection against fraud and provide a way to earn bonuses and perks that can enhance your financial situation.

Overview of FintechZoom

FintechZoom: The Go-To Platform for Financial Advice

FintechZoom is a trusted online platform that specializes in offering insights and recommendations for all things fintech. From investment advice to banking products, FintechZoom covers a wide range of financial services, including reviews and rankings of the best credit cards. They provide expert analyses and up-to-date information on the latest trends in the financial world.

How to Choose the Best Credit Card

Key Factors to Consider

While selecting a credit card, it’s important to assess your personal financial needs. Are you looking for cashback, travel rewards, or low interest rates? Here are some key factors:

- Annual fees: Some cards come with hefty fees, while others have none.

- Interest rates (APR): Pay attention to the interest rates, especially if you don’t pay your balance in full each month.

- Rewards programs: Different cards offer rewards on categories like dining, travel, and groceries.

- Sign-up bonuses: Many credit cards offer attractive bonuses for new users.

Understanding Your Spending Habits

Analyzing where and how you spend money is crucial. If you dine out frequently, a card that offers dining rewards may suit you. On the other hand, frequent travelers will benefit from cards offering airline miles or hotel points.

Top Credit Cards for Cashback in 2024

Best Overall Cashback Cards

Cashback credit cards are highly popular for their simplicity. Some top cashback cards include:

- Citi Double Cash Card: Offers all clients to 2% cashback on all purchases—1% when you buy something and another 1% when you pay.

- Chase Freedom Unlimited: Earns 5% cashback on travel and 1.5% on all other purchases.

Best Cashback Cards for Groceries

For grocery lovers, these cards offer higher returns:

- Blue Cash Preferred from American Express: Earn 6% cashback at U.S. supermarkets (up to $6,000 per year).

- Capital One SavorOne: Earn 3% cashback on groceries, dining, and entertainment.

Best Travel Rewards Credit Cards

Top Travel Cards for International Travelers

For those who love to explore the world for their enjoyment:

- Chase Sapphire Preferred: Offers 2x points on travel and dining for all clients , with no foreign transaction fees.

- American Express Gold Card: Earns 3x points on flights booked directly with airlines and offers access to travel benefits like lounge access.

Best Domestic Travel Credit Cards

If you’re more of a domestic traveler:

- Southwest Rapid Rewards® Priority Credit Card: Ideal for frequent Southwest flyers, offering 2x points on Southwest purchases.

- Bank of America® Travel Rewards Credit Card: A solid no-annual-fee option for domestic travel with 1.5x points on all purchases.

Low Interest Credit Cards

Best Cards for Low APR

If you carry a balance month to month, these low-interest cards can save you money:

- Citi Simplicity® Card: Offers a lengthy 0% introductory APR on purchases and balance transfers.

- Discover it® Cash Back: Provides a competitive low APR after the introductory period.

0% Introductory APR Cards

Cards offering 0% APR can be incredibly valuable:

- Wells Fargo Active Cash® Card: Offers 0% introductory APR for 15 months on purchases and also qualifying balance transfers easily.

Best Credit Cards for Students

Why Students Should Use Credit Cards

Credit cards can help students build credit early and teach responsible money management. Students often qualify for cards with lower limits and educational perks according to their financial balance .

Top Student Credit Cards for 2024

- Discover it® Student Cash Back: Provides complete rewards tailored for all students, including cashback on daily purchases of life.

- Journey Student Rewards from Capital One: Encourages on-time payments with an incentive to increase rewards.

Credit Cards with the Best Sign-Up Bonuses

Cards Offering the Most Generous Welcome Offers

Credit cards often offer sign-up bonuses that can give users a head start on earning rewards:

- Chase Sapphire Preferred®: Offers 60,000 bonus points after spending $4,000 in the given first three months.

- American Express Platinum Card®: Known for its luxurious perks and massive sign-up bonus, often worth over $1,000.

Best Cards for Building Credit

Secured vs. Unsecured Credit Cards

Secured credit cards require a deposit and are ideal for those with limited credit history. Unsecured cards don’t require a deposit but may have stricter approval requirements.

Best Cards for Improving Your Credit Score

- Capital One Platinum Credit Card: A solid option for building credit with no annual fee.

- OpenSky® Secured Visa® Credit Card: Doesn’t require a credit check which makes it accessible for those with poor credit.

Credit Cards with No Annual Fee

Why No Annual Fee Cards Are Popular

Cards with no annual fees allow you to enjoy rewards without the pressure of recouping the cost of a yearly fee.

Top No Annual Fee Cards for 2024

- Citi® Double Cash Card: Offers cashback with no annual fee.

- Chase Freedom Flex℠: Provides rotating categories of 5% cashback.

Premium Credit Cards

Best High-End Credit Cards with Exclusive Perks

For those willing to pay high annual fees, premium cards provide luxury perks like lounge access, concierge services, and extensive travel benefits.

Is a Premium Credit Card Worth It?

If you frequently use premium services like airport lounges or exclusive hotel programs, these cards can offer great value.

Credit Cards for Small Business Owners

Best Business Credit Cards for Entrepreneurs

- Ink Business Preferred® Credit Card: Offers high rewards on business expenses like shipping, advertising, and travel.

- American Express Business Gold Card: Flexible points and robust business tools make this card a strong choice.

Benefits of Using Business Credit Cards

Business credit cards help separate personal and business finances, provide rewards for business expenses, and improve cash flow management.

How to Maximize Credit Card Rewards

Tips for Earning the Most Points

Maximize your rewards by aligning your spending with your card’s reward categories, paying off balances in full, and taking advantage of bonus points and special offers.

How to Use Rewards Responsibly

While it’s fun to earn rewards, it’s crucial to avoid overspending just to gain points. Always focus on your financial well-being first because its make person strong.

Common Mistakes to Avoid with Credit Cards

Over-Borrowing and Debt

It’s easy to fall into the trap of spending more than you can afford. Make sure to stick to a budget and avoid carrying a high balance.

Missing Payments and Interest Rates

Missing payments not only harms your credit score but also increases the interest you’ll owe. For your relaxation always set up automatic payments to avoid late fees.

Conclusion

Choosing the right credit card depends on your financial goals, spending habits, preferences and also comfortable. Whether you’re looking for cashback, travel rewards, or a card to help build credit, there’s a perfect option out there for you. Always compare the features, benefits, and terms before applying to ensure the card you choose fits your lifestyle and financial needs.

FAQs

- What is the most famous credit card for cashback in 2024? The Citi Double Cash Card is highly recommended for its 2% cashback on all purchases.

- Which travel card offers the best rewards? The Chase Sapphire Preferred® is a top choice for travel rewards, offering 2x points on travel and dining.

- What is a secured credit card? A secured credit card requires a cash deposit, which acts as collateral and determines your credit limit.

- Can I get a credit card with no credit history for my comfortable? Yes, many student and secured credit cards are designed for those with no or limited credit history.

- Is it worth paying an annual fee for a credit card or not? It depends on the card’s benefits. If the rewards and perks outweigh the fee, then it can be worth it.